We are pleased to provide this report to members on the financial outcomes of WACHS.

Over the last two years, the finance team has worked hard to implement a range of financial objectives to guide decision making in the organisation. WACHS have a number of key strategic objectives in terms of financial management. The purpose of these objectives is:

To achieve these objectives a range of financial benchmarks has been established. These benchmarks inform decision-making and guide growth. The following objectives are of particular importance:

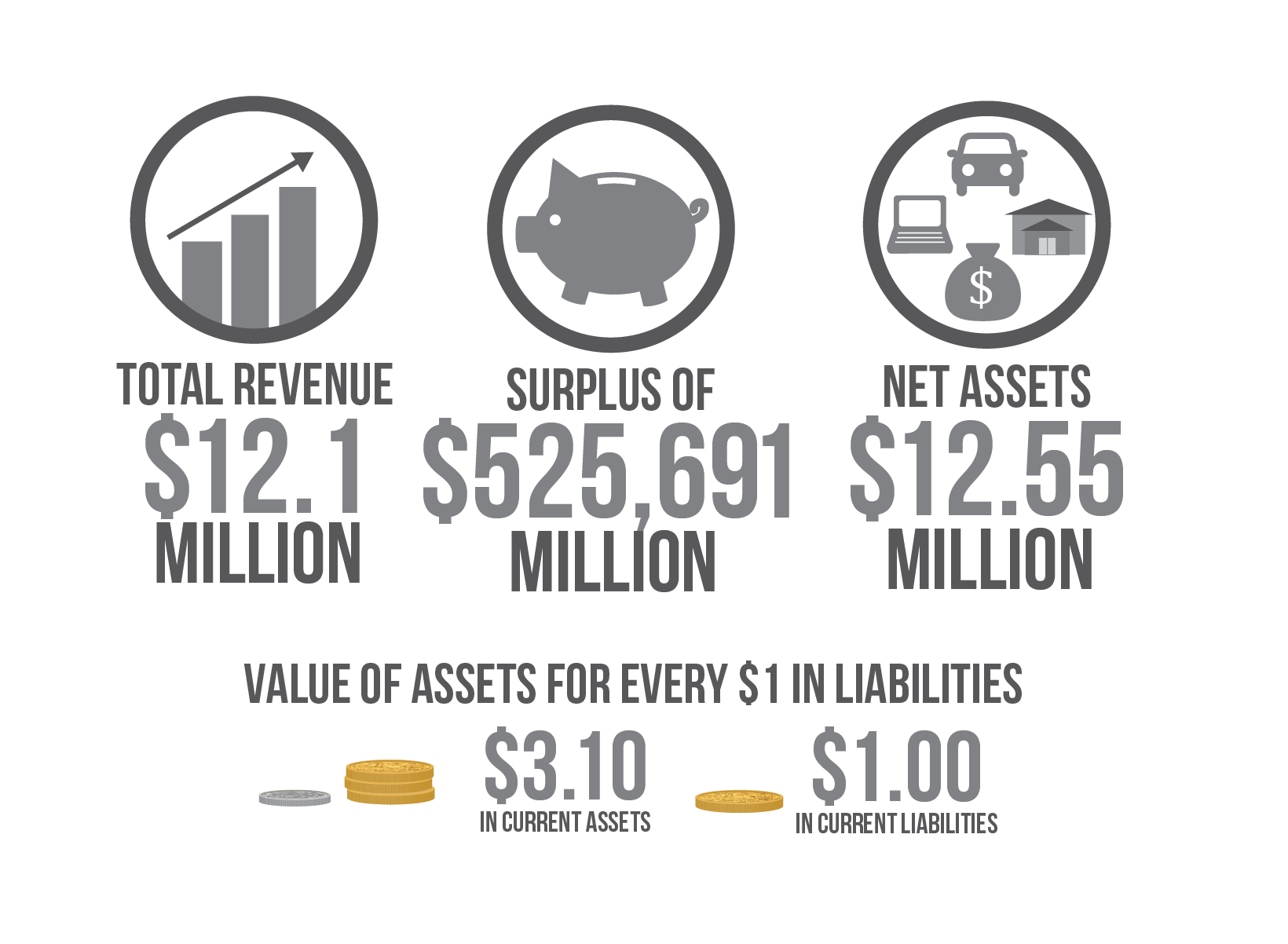

We are pleased to report that net assets increased $1.53m to $12.55m (an annual increase of 13.88%). Total assets are currently 5.03 times total liabilities.

The corporation has maintained a liquidity ratio well in excess of our target (2:1). For every $1 in current liabilities, the Corporation has $3.10 in current assets. This suggests that the Corporation maintains sufficient cash and equivalents to fund our current activities and to support our growth objectives.

The Corporation had Grant income (net of unexpended grants) of $12.1m, an annual increase of $3.27m. There was further growth in Medicare income (an increase of $182,317, which is largely attributable to the opening of Greater Western Aboriginal Health Service in April 2017).

An audit of assets held by the Corporation indicated that a substantial number of assets in the corporations asset register no longer had the carrying value attributed to them in the records. These values were adjusted, with over $400,000 recorded in the income statement as a loss on disposal. Despite this, overall income increased $3.79m.

The corporation recorded a surplus of $525,691. This exceeds our target of achieving a $500,000 surplus in our Management fund. These funds are set aside to invest in programs and assets, which will benefit our community. The largest investment in this financial year was the purchase and refurbishment of the Warne Street building, which provides modern facilities for the delivery of our Social and Emotional Wellbeing Programs, and an ongoing source of rental income for the Corporation.

Over the last couple of years, the Corporation’s growth has been impressive, with that growth managed in accordance with the financial objectives and processes established. Since 2014, the Corporation has recorded growth in net assets of over $5m (an increase of 68%). The Corporation is in a very strong financial position.

Joseph Holloway & Co Pty Ltd

© Wellington Aboriginal Corporation Health Service 2025. All Rights Reserved.

Website By: Logo Pogo. Privacy Policy. Terms of Use